Insurance

Protect your future whilst protecting theirs!

If you sell insurance as part of your financial-services business

then you'll welcome how LinxCRM keeps complete records for you with

everything at your fingertips. You'll see everything from your

Client Fact Find records, the amount of cover provided, any

important review dates and - not to be underestimated - every

commission you are due.

If you also provide associated services like finance or financial

planning then having all the information collected together on the

one client file will be a great asset in giving informed advice to

your client.

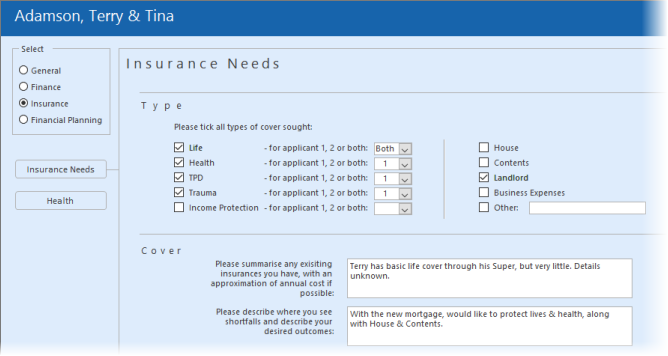

Client Fact Find

The powerful Client Fact Find will allow you to easily establish with your client their insurance needs.

Even if insurance is only incidental to your business, the Fact Find is a great way to introduce the subject to your client, whilst gathering other information, such as their loan needs.

You can either complete the Fact Find with the client or email them a PDF to complete.

Risk fact-finder

If you advise your client on risk insurance then you'll want to use the LinxInsure module available as part of LinxCRM Professional*. This goes beyond the standard Client Fact Find (above) with a detailed Fact Find as well as a Needs Analysis.

It will automatically prompt you for the typical questions to ask your client and then generate the necessary documentation by merging to your templates - Disclosure Statements, Statements of Advice, Customer Declarations for signing, etc. By simply and quickly merging the data with MS Word and attaching selected reports you should find it easy to put together a very comprehensive - and compliant - proposal for your client.

*(Some restrictions apply in New Zealand.)

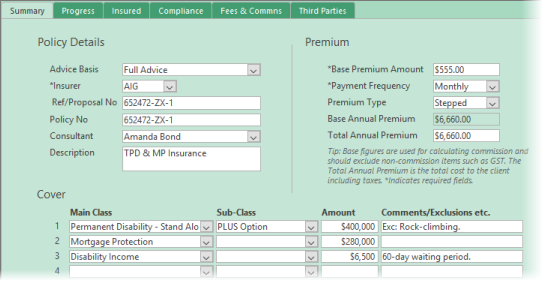

Full policy details

There's far more than just a simple comment on the file to show the client has a policy. LinxCRM lets you enter everything you need to know about the protection you have provided, including the amount of cover, premium, lives insured and so much more.

For general insurance you can record details of the car, boat, tractor or just about anything else.

You can even record details of existing cover provided by third-parties so that you can see the entire picture to help you with any review.

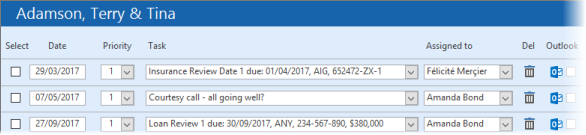

Never forget a renewal or review

There's a lot of pressure on clients to move their insurance elsewhere and they may be sorely tempted if they focus on premium alone.

Only you can show them the value in keeping their policy with you - so why let someone else get in first?

LinxCRM will automatically prompt you to contact the client prior to a renewal review date. That way you can be proactive in retaining that hard-won customer.

That's just one of the many automation features in LinxCRM. Learn more about Automation.

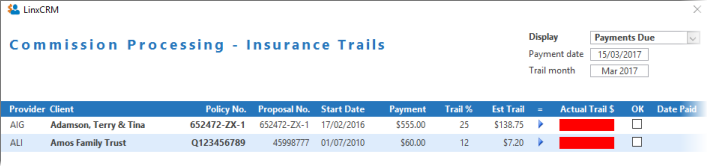

Track commissions

Tracking commissions on insurance can be a nightmare, especially as there are so many different ways that premiums are paid - annually, quarterly, weekly and so on.

But LinxCRM works hard to ensure you get paid every cent you are due for the life of the policy. Learn more about commissions.